Why is double-entry bookkeeping more advantageous than single-entry accounting?Ī single-entry system may work for small companies that have a low volume of activity. Why use double-entry bookkeeping instead of a single-entry method? Any cash remaining is your equity, which is the true value of your business.ĭouble-entry bookkeeping keeps this equation balanced so that the total dollar amount of assets minus liabilities equals total equity. Think about the equation this way: Imagine you sell all of your firm’s assets for cash, and you use the cash to pay off all of your accounts payable balances and your long-term debt.

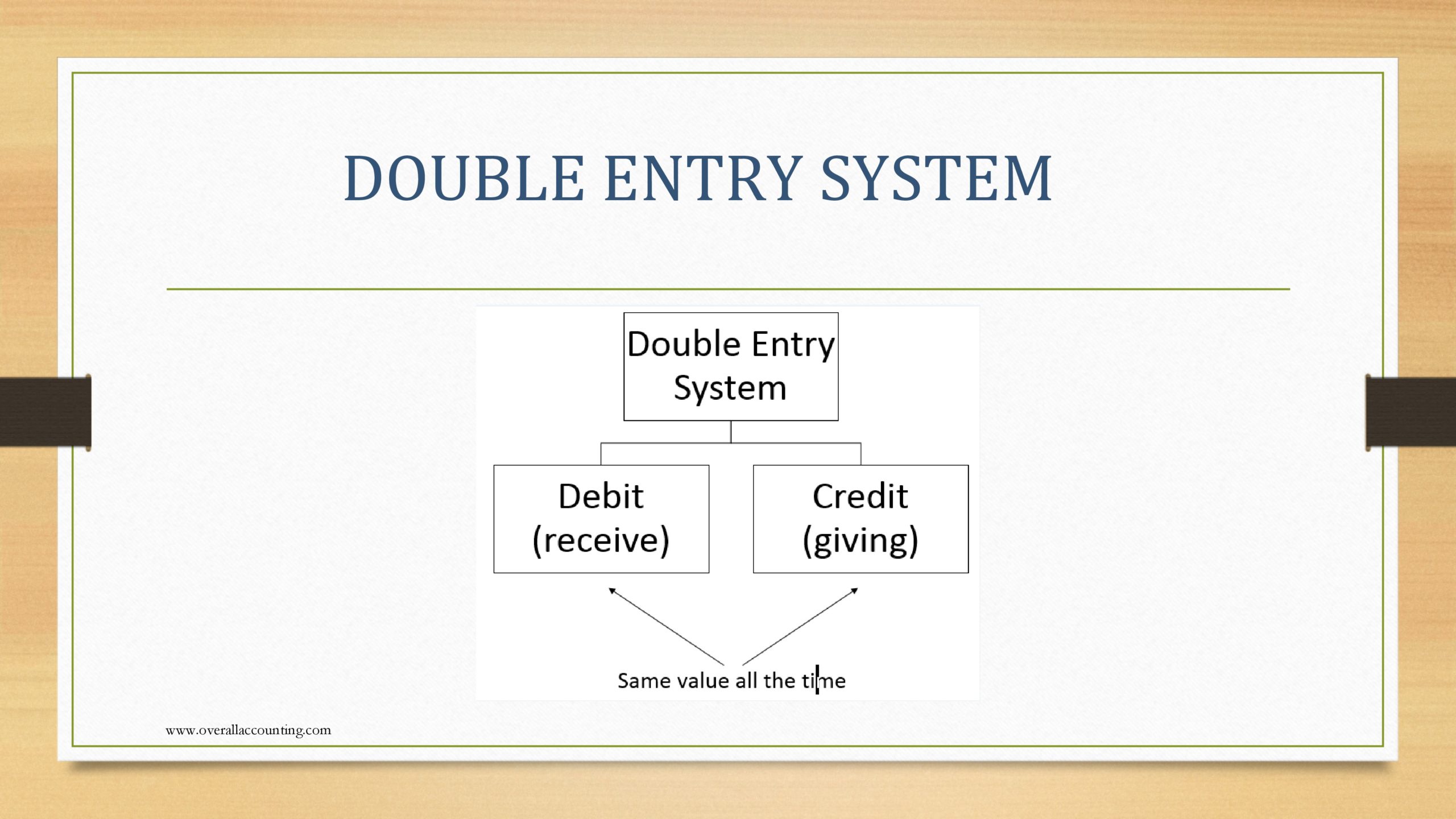

These categories can also be presented in the balance sheet equation: Under the double-entry system, if you increase an account with a debit, you will need to decrease an opposite account with a credit.ĭouble-entry bookkeeping starts with the balance sheet equation, which is divided into three subcategories: assets, liabilities, and equity. Furthermore, the double-entry accounting system also requires total debits to equal total credits in the general ledger.Īs you’ll see in the accounting equations and examples that we detail below, debits are entries that increase asset and expense accounts, or decrease revenue, equity, and liability accounts.Ĭredits are entries that do the opposite - they increase revenue, liability and equity accounts, while they decrease asset and expense accounts. The chart of accounts can have dozens, if not hundreds, of accounts. The accounts that bookkeepers use exist in the chart of accounts. The double-entry accounting method is a system of bookkeeping that requires bookkeepers to record every financial transaction twice, one time in each of two separate accounts. Double-entry bookkeeping is used to minimize accounting errors and to keep the books in balance.

#DOUBLE ENTRY BOOKKEEPING SOFTWARE#

Using accounting software can automate this process, making it easier for business owners to log and track transactions.īookkeeping supports every other accounting process, including the production of financial statements and the generation of management reports for company decision-making. Documentation is particularly relevant for more complicated operations, such as payroll. Linking each accounting entry to a source document is essential because the process helps the business owner justify each transaction. When entering business transactions into books, bookkeepers need to ensure they link and source the entry. If a business ships a product to a customer, for example, the bookkeeper will use the customer invoice to record revenue for the sale and to post an accounts receivable entry for the amount owed. A bookkeeper reviews source documents - like receipts, invoices and bank statements - and uses those documents to post accounting transactions. The term bookkeeping refers to a business’s record-keeping process.

0 kommentar(er)

0 kommentar(er)